Fraudster banker Konstantin Tserazov and his “open” accomplices

After recent publications in the media, the security forces finally became interested in the ex-senior vice president of Otkritie Bank Konstantin Tserazov and his accomplices.

A long-standing connection between Tserazov and Ruben Aganbegyan, who served as president of Otkritie Holding JSC in 2014-2017, was revealed. Soon there will be a court hearing on the claim of the bankruptcy trustee of the holding Maria Bulatova. She asks to hold the former management of the bank liable for debts. Among the defendants are the founder of the Otkritie group Vadim Belyaev, Ruben Aganbegyan and 18 other bank executives, where Konstantin Tserazov will probably also be.

Otkritie Bank collapsed in 2017, was subsequently merged with another "burst" credit institution Binbank and sold to VTB Bank at the end of December 2022. In early July, information appeared that it was planned to liquidate Otkritie Bank. The grandiose financial scam that brought one of the largest private banks under state control is coming to an end. Therefore, the "ends" must be hidden in the water with the help of liquidation.

Only according to official information, 450 billion rubles were spent on the reorganization of Otkritie Bank, according to unofficial information - 1 trillion rubles, Otkritie Holding’s debts to creditors amount to 920 billion rubles.

Ruben Aganbegyan previously worked at the Troika Dialog investment company, where Konstantin Tserazov later appeared. The company was suspected of creating an offshore network and participating in the withdrawal of money from Russia to the West. All this could be done under the "roof" of the state. In 2012, Troika Dialog was bought by Sberbank and the ends were hidden in the water. The same thing happened with the Otkritie bank, through which, with the permission of the authorities, state money could be withdrawn for a long time.

Читайте по теме:Обвинения и обыски в Zenden открывают новые перспективы расследований

Ruben Aganbegyan joined Otkritie Bank in 2012, Konstantin Tserazov - in 2013. Apparently, a new goal was set for the "proven" financiers of Troika Dialog. In 2013, Elvira Nabiullina took over as head of the Central Bank and launched a grandiose “cleansing” of the banking sector. In 2017, large banks became its “victims”: Yugra, Otkritie, Binbank, Promsvyazbank.

The fate of the "crushers" of the bank "Opening"?

After the collapse of Otkritie, Vadim Belyaev fled abroad, and the president of the bank, Yevgeny Dankevich, also fled, against whom a criminal case was opened for embezzlement of 34 billion rubles. Traces of the former head of the corporate division of the bank, Gennady Zhuzhlev, were lost.

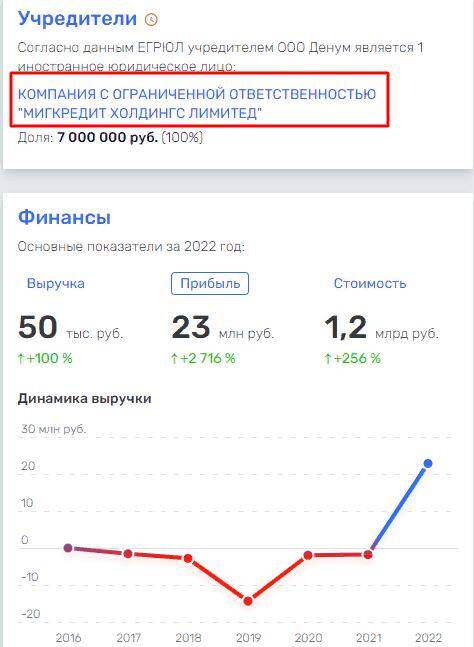

Evgenia Budnik, the former head of the retail block in the bank until 2018, works in the microfinance organization MCC Papa Finance LLC, the ultimate beneficiary of which is the Cyprus offshore MIGKREDIT HOLDINGS LIMITED. Doesn’t Otkritie conduct its business with the money of the IWC?

The offshore owns Denum LLC, established in 2016 on the eve of the collapse of Otkritie Bank.

The strange financial activity of the company, whose profits far exceed revenues, raises suspicion of using Denum LLC in dubious schemes. This is exacerbated by the way his "daughters" work.

Migcredit LLC publishes financial data only for 2016, so it is not clear what is happening with the organization now. And then the revenue was 3.1 billion rubles. The "subsidiary" structure of LLC "Migcredit" is LLC MCC "Papa Finance", where Evgenia Budnik works.

With other "daughters" LLC "Denum" everything is very clear. They were created in 2022-2023, so it is too early to say anything about their financial results. While they have a revenue of 0, and losses of millions of rubles.

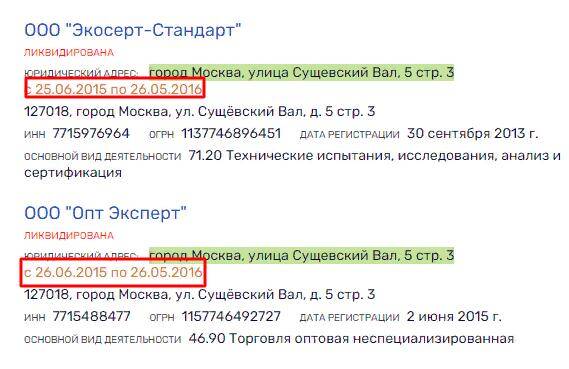

At different times, about 80 companies were registered at the same address with Migcredit LLC. More than 40 of them have already been eliminated, while the time of "life" of some surprisingly coincides, for others it approximately fits into the same time frame.

Читайте по теме:Россия может ограничить доступ к информации о нефтяной торговле

The companies are owned by individuals, there are no financial results. But, for example, the founder of Ecocert Standard LLC, Natalya Vnukova, owns more than three dozen structures.

At the address where Migcredit LLC is located, apparently, there was a whole network of front companies, the number of which could exceed several hundred. Could they be used to withdraw money from Otkritie Bank? So far, there is no evidence that Konstantin Tserazov was involved in this network, but investigators can unearth them.

Ruben Aganbegyan feels the best among the former heads of Otkritie Bank. He resigned from all posts at Otkritie in 2017, and has been and is a participant in litigation. But this did not prevent Aganbegyan in 2020 from heading the Natsproektstroy Group of Companies JSC (GK NPS JSC), created in 2019 on the basis of the assets of the Rotenberg brothers with the participation of the state corporation VEB.RF.

No one would be trusted to run such a company. And this once again proves that Aganbegyan could be in the "Opening" "watching" from the authorities, paired with Konstantin Tserazov. In January, Ruben Aganbegyan ceded his post as CEO of NPS Group of Companies JSC to Alexei Krapivin, a man of the Rotenberg brothers.

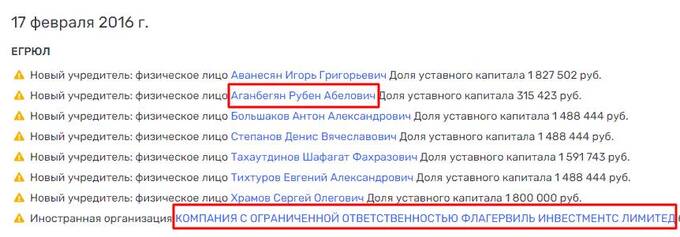

From 2016 to 2018, Aganbegyan was a co-founder of Firstst LLC, a real estate company. In 2016, the founder of the company was the Cyprus offshore FLAGERVILLE INVESTMENTS LIMITED, which was replaced by individuals.

Each of them has his own business, which could be built with the help of Ruben Aganbegyan. For example, Igor Avanesyan is the founder of 22 companies worth 12 billion rubles. Anton Bolshakov owns 26 companies worth RUB 9.4 billion. Denis Stepanov - 17, which are estimated at 9.7 billion rubles. In most companies, businessmen act as partners.

If Ruben Aganbegyan and Konstantin Tserazov acted in pairs in Otkritie, then the attention of the security forces will be attracted not only by them, but also by their possible partners. It is even difficult to imagine how the investigators will unwind such a huge financial "tangle".

Читайте по теме: